We deal with thousands of companies in the process of fundraising. Last year, I spoke to over 1,000 founders, and I've set a personal goal to beat that this year.

These companies mostly come to me for office hours, and most of the time, their questions revolve around fundraising. One thousand people are enough to detect some patterns: the mistakes these companies are making when approaching their fundraising.

1. Fundraising to hire the essential team

This is probably the most common question I get: a solo founder is looking to raise money to find a CTO, or a CMO/growth hacker.

My theory on where this issue comes from is that typically, the personality of an entrepreneur/founder/CEO/hustler is not the kind of individual that will choose software engineering as a career path.

A lot of the founders I come across have a ton of ideas for product, and a ton of ideas on how to sell them, but can't build the products themselves: we end up with CEOs looking for their CTO and not being able to find them.

That is just the reality of the world, and there's little we can do about it. I've said it before: finding that product co-founder is probably one of your first tests as an entrepreneur.

An alternative is... you know, learning to code: the problem is you'll soon find yourself swamped and unable to split your time between building the product and selling it.

Investors expect you to have a team by the time you get to meet with them. Few investors will fund a company where a team isn't built, because nobody wants that essential personnel to come for the money/salary that you'll offer them. The first 2-3 team members need to come on board because they believe in the product and are willing to take a WAY BELOW market salary until the company can afford it.

2. Requesting an NDA

This is just plain rookie.

Investors don't sign NDAs to see your pitch deck. No matter how groundbreaking the product is, no matter how many patents you can get.

- A Pitch Deck is supposed to be an introduction to the business. It shouldn't dive deeply into sensitive economics or technology aspects: that comes later.

- If you are concerned, somebody can steal your idea and beat you to market by just looking at your pitch deck, then that risk will continue to exist when you launch. Companies don't succeed because of ideas: they succeed because of execution: building great products and bringing them to market.

- Most investors look at hundreds of deals every month, and it's a terrible liability to have NDAs with all these companies.

3. Approaching the wrong kind of investors

Not all companies can (or should) approach venture capital investors. We talked about this in our Startups vs Small Businesses video.

If you want to raise money from Silicon Valley-type investors, you need to have a business that can scale to, say, $100MM/yr in revenue- it needs to have a tech variable/aspect and small human capital requirements.

That excludes most consulting businesses as well as companies without a tech advantage.

Silicon Valley investors putting money on a seed-stage round company will generally invest in the range of $500K to $1MM in exchange for 15-25% of the business (usually done through a Convertible Note).

They expect the business to increase its value in 10X within five years: which requires exponential growth.

Companies that don't fit this profile can access other types of financing, like loans. They can also raise capital from an investor willing to come in as a 50/50 partner and to be directly involved in the business. There's also stuff like Kickstarter, which is ideal for hardware products.

It's about understanding the kind of business you have in your hands, what it is, and what it's not.

4. Trying to raise too much money

I've seen entrepreneurs with no team, no product, no revenue, pitching a round of $5MM, which for most industries and most founders, will also be, a rookie move.

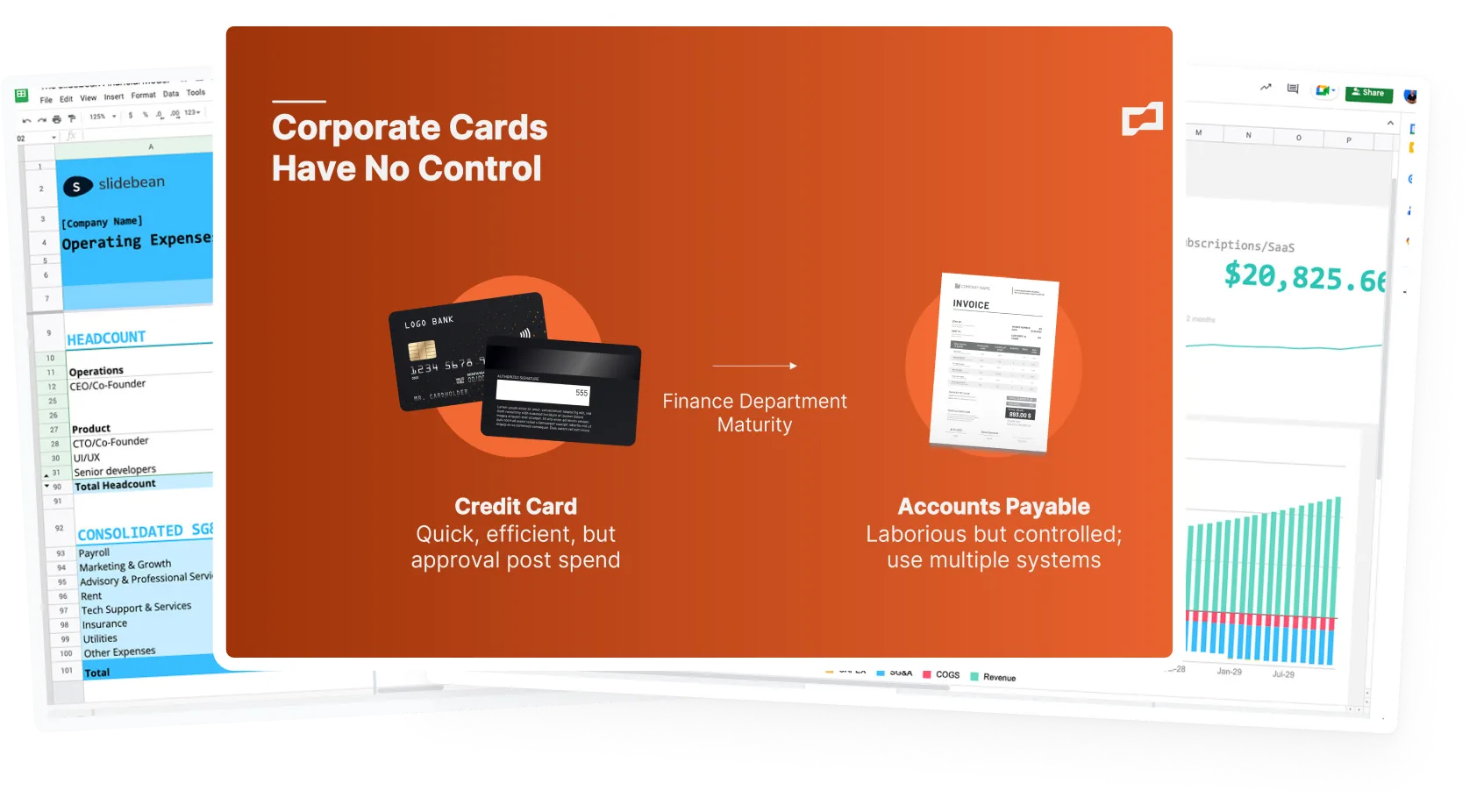

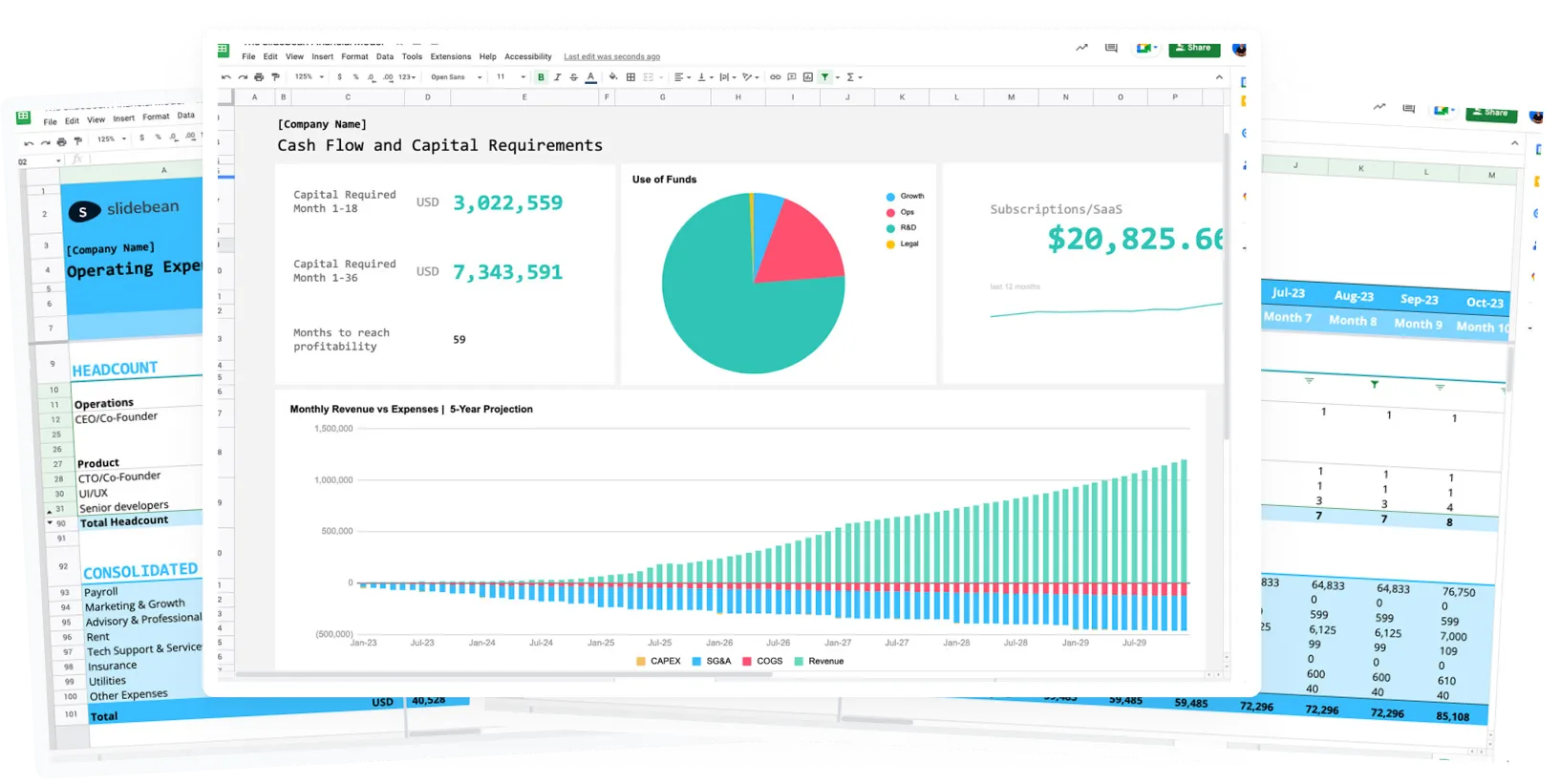

Raising money is diluting your company ownership: you always want to raise the least amount of money possible, and that's why a good Financial Model is important.

5. Showing that you’re desperate

Investors like healthy, fast-growing companies. They are drawn to the promise of great returns! Few investors will want to join to save a business from bankruptcy, because that's usually just bad business. The least you need them, the better position you have, not only to pitch the company but to have the leverage to negotiate better terms.

And that’s it for today! Remember to subscribe to our channel and hit that bell to receive notifications when new content is published.

Make sure to visit slidebean.com/live to join our Discord server. What happens there? Well, after these videos are launched, I’ll be answering your questions and comments live for the next hour.

We deal with thousands of companies in the process of fundraising. Last year, I spoke to over 1,000 founders, and I've set a personal goal to beat that this year.

These companies mostly come to me for office hours, and most of the time, their questions revolve around fundraising. One thousand people are enough to detect some patterns: the mistakes these companies are making when approaching their fundraising.

1. Fundraising to hire the essential team

This is probably the most common question I get: a solo founder is looking to raise money to find a CTO, or a CMO/growth hacker.

My theory on where this issue comes from is that typically, the personality of an entrepreneur/founder/CEO/hustler is not the kind of individual that will choose software engineering as a career path.

A lot of the founders I come across have a ton of ideas for product, and a ton of ideas on how to sell them, but can't build the products themselves: we end up with CEOs looking for their CTO and not being able to find them.

That is just the reality of the world, and there's little we can do about it. I've said it before: finding that product co-founder is probably one of your first tests as an entrepreneur.

An alternative is... you know, learning to code: the problem is you'll soon find yourself swamped and unable to split your time between building the product and selling it.

Investors expect you to have a team by the time you get to meet with them. Few investors will fund a company where a team isn't built, because nobody wants that essential personnel to come for the money/salary that you'll offer them. The first 2-3 team members need to come on board because they believe in the product and are willing to take a WAY BELOW market salary until the company can afford it.

2. Requesting an NDA

This is just plain rookie.

Investors don't sign NDAs to see your pitch deck. No matter how groundbreaking the product is, no matter how many patents you can get.

- A Pitch Deck is supposed to be an introduction to the business. It shouldn't dive deeply into sensitive economics or technology aspects: that comes later.

- If you are concerned, somebody can steal your idea and beat you to market by just looking at your pitch deck, then that risk will continue to exist when you launch. Companies don't succeed because of ideas: they succeed because of execution: building great products and bringing them to market.

- Most investors look at hundreds of deals every month, and it's a terrible liability to have NDAs with all these companies.

3. Approaching the wrong kind of investors

Not all companies can (or should) approach venture capital investors. We talked about this in our Startups vs Small Businesses video.

If you want to raise money from Silicon Valley-type investors, you need to have a business that can scale to, say, $100MM/yr in revenue- it needs to have a tech variable/aspect and small human capital requirements.

That excludes most consulting businesses as well as companies without a tech advantage.

Silicon Valley investors putting money on a seed-stage round company will generally invest in the range of $500K to $1MM in exchange for 15-25% of the business (usually done through a Convertible Note).

They expect the business to increase its value in 10X within five years: which requires exponential growth.

Companies that don't fit this profile can access other types of financing, like loans. They can also raise capital from an investor willing to come in as a 50/50 partner and to be directly involved in the business. There's also stuff like Kickstarter, which is ideal for hardware products.

It's about understanding the kind of business you have in your hands, what it is, and what it's not.

4. Trying to raise too much money

I've seen entrepreneurs with no team, no product, no revenue, pitching a round of $5MM, which for most industries and most founders, will also be, a rookie move.

Raising money is diluting your company ownership: you always want to raise the least amount of money possible, and that's why a good Financial Model is important.

5. Showing that you’re desperate

Investors like healthy, fast-growing companies. They are drawn to the promise of great returns! Few investors will want to join to save a business from bankruptcy, because that's usually just bad business. The least you need them, the better position you have, not only to pitch the company but to have the leverage to negotiate better terms.

And that’s it for today! Remember to subscribe to our channel and hit that bell to receive notifications when new content is published.

Make sure to visit slidebean.com/live to join our Discord server. What happens there? Well, after these videos are launched, I’ll be answering your questions and comments live for the next hour.