We did a video a couple of weeks back on how equity works at startups, but one question that kept coming up was about profits: how do you distribute profits?

It’s a fair question. Business school 101 will teach you that for a company to thrive, you need profits! And business 101 is right, but that doesn’t exactly apply to startups.

When Facebook bought Instagram back in 2013, they paid $1B for the platform. At the time, Instagram had not generated a single dollar of revenue - it was all expenses - and yet, Instagram's founders, investors, and hopefully, employees walked out with large paychecks from that exit.

Why such crazy numbers for a platform that generated no revenue? Since it was acquired, Instagram HAS generated billions of dollars in revenue for Facebook, and since Facebook stopped being cool, you could argue that Instagram is all they’ve got to lure young audiences.

So Instagram made a profit, eventually. Except that Instagram’s original investors never collected any of the profits from Instagram. They didn’t want to, and they never intended to. But why?

So in this article I want to explain how the profit model works, run through some scenarios of different companies, and clarify why, for venture capital investors, profits are just boring.

How do profits work for a traditional business?

Let’s use a very traditional, but very common business as an example: a marketing agency.

This company will probably have 2 main departments:

- Growth: Which means sales, marketing, and business development

- Costs: Which means the people who are in charge of doing the work, designers, and marketers. In a financial model, these are the expenses that scale with your revenue and classify as Costs of Goods Sold.

As the company gets more clients, it makes more revenue, but it also has its costs increase proportionally. More clients means more brains to deliver work to those clients. There are other costs as well, such as admin and HR, and they also have to scale more or less proportionally to staff. So as your business grows, the amount of people grows too.

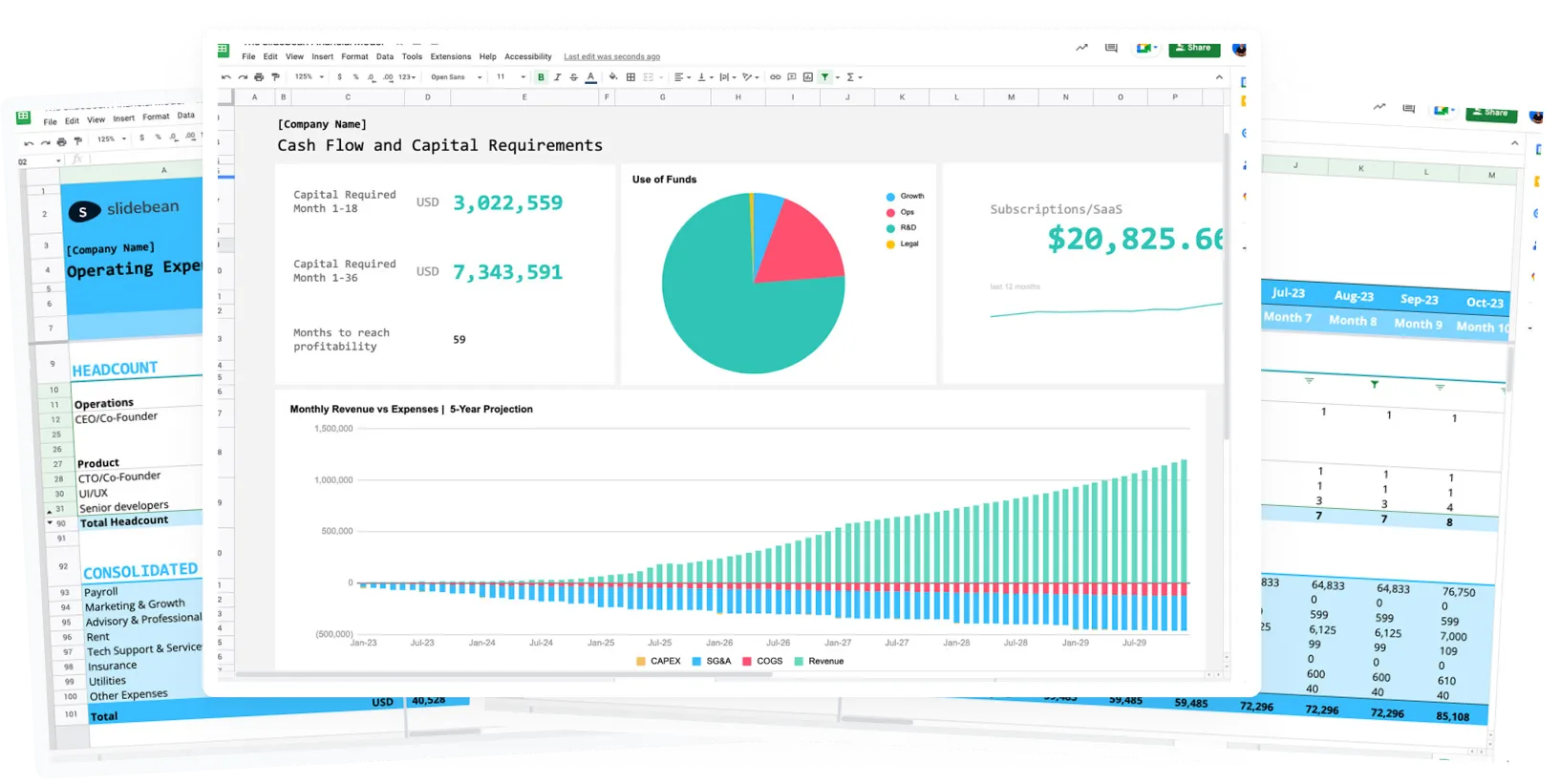

Let’s say that you scale this company to be an organization with 50 people and about $10MM in annual revenue. Now, while the gross margin on the services might be, say, 40%, the net margin (after accounting for all the overhead costs) usually ends up being about 5-7%. So if this company made $10M, after paying all the staff and all the costs, it ends up with around $750,000 in EBITDA (earnings before interests, taxes, depreciation and appreciation). The company must then pay taxes on that money. In the US, that’s state and federal. Let’s round that to 25%, so the company ends up with $562,500 in pure profit.

Now the company can pay that to shareholders; that’s usually a board decision. So the board agrees that they will keep $162K in accounts as a cushion in case there’s a recession or a global pandemic, so they will pay out $400K to shareholders.

Let’s imagine this company got started by 3 co-founders on equal share distribution, so each of them will get about $133K for the year. Right? Nah ah!

Not yet. You forgot about taxes. What, again? Yes, again. That’s the double tax on dividends which applies in many countries. Assuming these guys are single and they are already making around $150K in salary from the company or other income, they are now generating an additional $133K in the year, which effectively moves them from a marginal tax rate of 24% to the full 35%.

It’s even worse if you are not a US taxpayer. In those cases, you are taxed at a nasty, flat 30% on dividends but assuming these guys live in Brooklyn, the additional take-home income they generate is down to $74,247 after the extra taxes. However, that’s the founders - in this article, we’re talking about investors.

Why are profits not necessary for a startup?

Let’s imagine that this company raised some money to get off the ground. An investor came in and invested $500K to get the company started, for which they received 15% of the company.

If you want to see how this math works, check out our video on Cap Tables.

Now that investor will make $60K from this $400K dividend distribution (15%, equivalent to their ownership percentage - BEFORE taxes). Assuming that the company continues to operate the same way, it will take them years, maybe even decades, to even recoup 1x of their original $500,000 investment.

That is just too slow. They won’t have liquidity (access to that money) for years since they can’t really get that money out. It’s also risky; the company might fail, as many startups do. They are also at the mercy of what the board decides; on a 15% stake, they probably only have one vote in 3 or one vote in 5, not enough to guarantee dividends. The Board might wish to keep all dividends in the company, to re-invest in growth - which is not a bad idea.

So that’s not an exciting scenario. That is why ‘traditional’ businesses that have such slim margins can’t raise money the same way startups do. That is not the venture capital business.

There are investors that will fund a more traditional business, but checks are usually smaller, and the equity stake needed will be much larger. For example, a restaurant may have a financial/executive founder who brings the capital, and the chef, or the operator, who runs the business - and they go 50/50. The risk is still there, but the ROI comes sooner because it’s half of the profits.

How do startups survive million-dollar rounds without profit?

So why do tech startups get away with million-dollar rounds and small equity stakes?

Taking profits out of a business is not the only outcome for a business. Aside from dying, which is a possibility, a business can either be acquired or IPO, and both of those are very exciting because payday comes quickly. Venture capitalists expect an acquisition in 7 or 9 years because then they can cash out, take the profit, and use the money for their next investment.

I still get the occasional founder that isn’t thinking about selling their company. They want to run it, and leave it to their children. That’s cute and totally fine - but it makes it incompatible with venture capital investors. It’s a different game; it’s a different business - not the game of venture capital and fast-scaling startups.

So exits are cool because investors don’t have to wait to collect the profits; they collect the price per share that the buyer is paying, and that means an entirely different ball game.

In many acquisitions, profits are irrelevant.

What are the different acquisitions scenarios for tech startups?

Let me give you some examples of common acquisition scenarios for a tech startup.

Acqui-hire

The easiest example to understand is the acqui-hire. This is a startup term coming from acquisition and hiring and is when a company buys out a startup not so much because of their product, definitely not because of their revenue, but because of their talent.

The first example that comes to mind is a company called Fly Labs, founded by a couple of good friends. They made this really cool, simple video editing platform. They had seen some success in the App Store and had raised about $1.5M, but it was clear that they were going to need a lot more capital to reach market dominance.

It’s blurry what information I know that’s not public, but I can probably reveal that they were not profitable.

Various companies reached out to buy them: mostly because their technology was kinda useful for them, but mostly because the team that built this powerful app would be really useful for that organization. Google ended up buying them out, for an undisclosed amount, to join their Google Photos team.

When you have undisclosed acquisition amounts, it’s usually because the number is not a ‘braggable’ number. The offer that a company like Google will make, of course, needs to be enough for investors to accept it (that means that whatever they invested, they need to at least recover), and for the founders and the rest of the team to be motivated to work at Google for a few years.

There’s usually a combination of cash (for the investors to leave happy) and vesting stock or time-based bonuses for the team - so that, again, they stay with the buyer for a few years.

A benchmark that you will hear about sometimes is $1M per engineer, which may sound crazy. It’s not that each engineer gets $1M; it’s that the company is valued on how many engineers it brings to the buyer.

Why? Well, because engineers are expensive, hard to find, and hard to recruit. If you can find a team that already has rapport and has proven expertise on a given challenge, and you can bring that whole team to implement that technology to your stack, then this effectively removes a lot of costs and risks of building that team by hiring strangers.

Investors don’t make much money on acqui-hires; they usually get paid from 1x to maybe 1.5x their original investment. Acqui-hires are cool, but they are mostly a soft landing.

Customers/Audience

Other acquisitions can be more strategic, like when Hubspot acquired The Hustle, or when Business Insider acquired MorningBrew.

These acquisitions are happening to buy out an audience.

Hubspot revealed that when the purchase happened, the Hustle had about 1.5M readers per month, and they did reveal that this is what they cared about the most: access to a new audience to continue growing their content marketing game.

We don’t know the acquisition price, but the internet seems to agree that it was between $25M and $30M.

And from that information, we can infer a few things. For example, we can do some math and estimate they paid about $20 per active reader. The Hustle had only raised about $1.3M in capital, so assuming the investors in that round ended up with 15% of the company, that’s about a 2x payout for them.

Morning Brew did even better, acquired for $75M by Business Insider. At the time of purchase, they had 2.5M readers, 500K subscribers, and 6 million downloads on their profile.

So both of these are media companies that were acquired not because of their revenue but because of their engaged audiences.

Audiences are very valuable. To the buyer, it means access to more people/more readers/more audience - to monetize them the same way they already do. They are also buying out competitors and removing risk, and they are bringing new, smart brains to their organization.

If we want to compare these acquisitions to that of Facebook acquiring the 25M Instagram users for $1B, it brings it to about $40 per user, but in this case, it’s not about the users or the revenue - it’s the strategic significance of Instagram for Facebook: younger users, fresh ideas, and even avoiding other competitors to buy them out.

The last example I’ll share today is a company called Quip, which was acquired by Salesforce for an estimated $750M.

Quip acquisition

Quip was a simple, well-designed office suite: a word processor and a spreadsheets platform. Not nearly as powerful as their Microsoft counterparts, but simple and intuitive. They had revenue and users when it was acquired, so that $750M price might have been a multiplier of their Annual Run Rate, but it related more to Salesforce’s end goal of building this OS for Sales.

At the time of purchase, according to Crunchbase, the company had raised $45M in two rounds of funding; a Series A and a Series B. Assuming both of those rounds added up to some 30% of the company, these investors went home with $225M, or a 5x multiplier on their investment, in just 4 years!!

That is venture capital ROI. Not percentages, but multipliers.

This gets even bigger if the company is not acquired but IPOs instead: when it’s listed in the stock market, the value of the stock is defined by the market, and sometimes those markets value companies well above their revenue, just on their potential to change the world.

Whether that’s real or not matters little to the original investors. As a public company, they can cash out, and they will have made 10x, 50x, or 100x their original checks - especially if they got in early.

All of this, of course, is extremely, extremely risky. Most startups will fail. If they are not generating profits, they depend on more investors to bet on them to continue building their vision. The cold hard truth is that the one 100x unicorns will pay for the remaining 90% of failed companies.

A bit of luck

A startup win is life-changing for us founders, and for a lucky (or smart) early-stage investor, it can too.

A startup exit also allows everyone to take what they learned and apply it to their new venture, with better chances of achieving that same feat again - and in this world of exits, profits aren’t your problem (yet).

I need investors

We did a video a couple of weeks back on how equity works at startups, but one question that kept coming up was about profits: how do you distribute profits?

It’s a fair question. Business school 101 will teach you that for a company to thrive, you need profits! And business 101 is right, but that doesn’t exactly apply to startups.

When Facebook bought Instagram back in 2013, they paid $1B for the platform. At the time, Instagram had not generated a single dollar of revenue - it was all expenses - and yet, Instagram's founders, investors, and hopefully, employees walked out with large paychecks from that exit.

Why such crazy numbers for a platform that generated no revenue? Since it was acquired, Instagram HAS generated billions of dollars in revenue for Facebook, and since Facebook stopped being cool, you could argue that Instagram is all they’ve got to lure young audiences.

So Instagram made a profit, eventually. Except that Instagram’s original investors never collected any of the profits from Instagram. They didn’t want to, and they never intended to. But why?

So in this article I want to explain how the profit model works, run through some scenarios of different companies, and clarify why, for venture capital investors, profits are just boring.

How do profits work for a traditional business?

Let’s use a very traditional, but very common business as an example: a marketing agency.

This company will probably have 2 main departments:

- Growth: Which means sales, marketing, and business development

- Costs: Which means the people who are in charge of doing the work, designers, and marketers. In a financial model, these are the expenses that scale with your revenue and classify as Costs of Goods Sold.

As the company gets more clients, it makes more revenue, but it also has its costs increase proportionally. More clients means more brains to deliver work to those clients. There are other costs as well, such as admin and HR, and they also have to scale more or less proportionally to staff. So as your business grows, the amount of people grows too.

Let’s say that you scale this company to be an organization with 50 people and about $10MM in annual revenue. Now, while the gross margin on the services might be, say, 40%, the net margin (after accounting for all the overhead costs) usually ends up being about 5-7%. So if this company made $10M, after paying all the staff and all the costs, it ends up with around $750,000 in EBITDA (earnings before interests, taxes, depreciation and appreciation). The company must then pay taxes on that money. In the US, that’s state and federal. Let’s round that to 25%, so the company ends up with $562,500 in pure profit.

Now the company can pay that to shareholders; that’s usually a board decision. So the board agrees that they will keep $162K in accounts as a cushion in case there’s a recession or a global pandemic, so they will pay out $400K to shareholders.

Let’s imagine this company got started by 3 co-founders on equal share distribution, so each of them will get about $133K for the year. Right? Nah ah!

Not yet. You forgot about taxes. What, again? Yes, again. That’s the double tax on dividends which applies in many countries. Assuming these guys are single and they are already making around $150K in salary from the company or other income, they are now generating an additional $133K in the year, which effectively moves them from a marginal tax rate of 24% to the full 35%.

It’s even worse if you are not a US taxpayer. In those cases, you are taxed at a nasty, flat 30% on dividends but assuming these guys live in Brooklyn, the additional take-home income they generate is down to $74,247 after the extra taxes. However, that’s the founders - in this article, we’re talking about investors.

Why are profits not necessary for a startup?

Let’s imagine that this company raised some money to get off the ground. An investor came in and invested $500K to get the company started, for which they received 15% of the company.

If you want to see how this math works, check out our video on Cap Tables.

Now that investor will make $60K from this $400K dividend distribution (15%, equivalent to their ownership percentage - BEFORE taxes). Assuming that the company continues to operate the same way, it will take them years, maybe even decades, to even recoup 1x of their original $500,000 investment.

That is just too slow. They won’t have liquidity (access to that money) for years since they can’t really get that money out. It’s also risky; the company might fail, as many startups do. They are also at the mercy of what the board decides; on a 15% stake, they probably only have one vote in 3 or one vote in 5, not enough to guarantee dividends. The Board might wish to keep all dividends in the company, to re-invest in growth - which is not a bad idea.

So that’s not an exciting scenario. That is why ‘traditional’ businesses that have such slim margins can’t raise money the same way startups do. That is not the venture capital business.

There are investors that will fund a more traditional business, but checks are usually smaller, and the equity stake needed will be much larger. For example, a restaurant may have a financial/executive founder who brings the capital, and the chef, or the operator, who runs the business - and they go 50/50. The risk is still there, but the ROI comes sooner because it’s half of the profits.

How do startups survive million-dollar rounds without profit?

So why do tech startups get away with million-dollar rounds and small equity stakes?

Taking profits out of a business is not the only outcome for a business. Aside from dying, which is a possibility, a business can either be acquired or IPO, and both of those are very exciting because payday comes quickly. Venture capitalists expect an acquisition in 7 or 9 years because then they can cash out, take the profit, and use the money for their next investment.

I still get the occasional founder that isn’t thinking about selling their company. They want to run it, and leave it to their children. That’s cute and totally fine - but it makes it incompatible with venture capital investors. It’s a different game; it’s a different business - not the game of venture capital and fast-scaling startups.

So exits are cool because investors don’t have to wait to collect the profits; they collect the price per share that the buyer is paying, and that means an entirely different ball game.

In many acquisitions, profits are irrelevant.

What are the different acquisitions scenarios for tech startups?

Let me give you some examples of common acquisition scenarios for a tech startup.

Acqui-hire

The easiest example to understand is the acqui-hire. This is a startup term coming from acquisition and hiring and is when a company buys out a startup not so much because of their product, definitely not because of their revenue, but because of their talent.

The first example that comes to mind is a company called Fly Labs, founded by a couple of good friends. They made this really cool, simple video editing platform. They had seen some success in the App Store and had raised about $1.5M, but it was clear that they were going to need a lot more capital to reach market dominance.

It’s blurry what information I know that’s not public, but I can probably reveal that they were not profitable.

Various companies reached out to buy them: mostly because their technology was kinda useful for them, but mostly because the team that built this powerful app would be really useful for that organization. Google ended up buying them out, for an undisclosed amount, to join their Google Photos team.

When you have undisclosed acquisition amounts, it’s usually because the number is not a ‘braggable’ number. The offer that a company like Google will make, of course, needs to be enough for investors to accept it (that means that whatever they invested, they need to at least recover), and for the founders and the rest of the team to be motivated to work at Google for a few years.

There’s usually a combination of cash (for the investors to leave happy) and vesting stock or time-based bonuses for the team - so that, again, they stay with the buyer for a few years.

A benchmark that you will hear about sometimes is $1M per engineer, which may sound crazy. It’s not that each engineer gets $1M; it’s that the company is valued on how many engineers it brings to the buyer.

Why? Well, because engineers are expensive, hard to find, and hard to recruit. If you can find a team that already has rapport and has proven expertise on a given challenge, and you can bring that whole team to implement that technology to your stack, then this effectively removes a lot of costs and risks of building that team by hiring strangers.

Investors don’t make much money on acqui-hires; they usually get paid from 1x to maybe 1.5x their original investment. Acqui-hires are cool, but they are mostly a soft landing.

Customers/Audience

Other acquisitions can be more strategic, like when Hubspot acquired The Hustle, or when Business Insider acquired MorningBrew.

These acquisitions are happening to buy out an audience.

Hubspot revealed that when the purchase happened, the Hustle had about 1.5M readers per month, and they did reveal that this is what they cared about the most: access to a new audience to continue growing their content marketing game.

We don’t know the acquisition price, but the internet seems to agree that it was between $25M and $30M.

And from that information, we can infer a few things. For example, we can do some math and estimate they paid about $20 per active reader. The Hustle had only raised about $1.3M in capital, so assuming the investors in that round ended up with 15% of the company, that’s about a 2x payout for them.

Morning Brew did even better, acquired for $75M by Business Insider. At the time of purchase, they had 2.5M readers, 500K subscribers, and 6 million downloads on their profile.

So both of these are media companies that were acquired not because of their revenue but because of their engaged audiences.

Audiences are very valuable. To the buyer, it means access to more people/more readers/more audience - to monetize them the same way they already do. They are also buying out competitors and removing risk, and they are bringing new, smart brains to their organization.

If we want to compare these acquisitions to that of Facebook acquiring the 25M Instagram users for $1B, it brings it to about $40 per user, but in this case, it’s not about the users or the revenue - it’s the strategic significance of Instagram for Facebook: younger users, fresh ideas, and even avoiding other competitors to buy them out.

The last example I’ll share today is a company called Quip, which was acquired by Salesforce for an estimated $750M.

Quip acquisition

Quip was a simple, well-designed office suite: a word processor and a spreadsheets platform. Not nearly as powerful as their Microsoft counterparts, but simple and intuitive. They had revenue and users when it was acquired, so that $750M price might have been a multiplier of their Annual Run Rate, but it related more to Salesforce’s end goal of building this OS for Sales.

At the time of purchase, according to Crunchbase, the company had raised $45M in two rounds of funding; a Series A and a Series B. Assuming both of those rounds added up to some 30% of the company, these investors went home with $225M, or a 5x multiplier on their investment, in just 4 years!!

That is venture capital ROI. Not percentages, but multipliers.

This gets even bigger if the company is not acquired but IPOs instead: when it’s listed in the stock market, the value of the stock is defined by the market, and sometimes those markets value companies well above their revenue, just on their potential to change the world.

Whether that’s real or not matters little to the original investors. As a public company, they can cash out, and they will have made 10x, 50x, or 100x their original checks - especially if they got in early.

All of this, of course, is extremely, extremely risky. Most startups will fail. If they are not generating profits, they depend on more investors to bet on them to continue building their vision. The cold hard truth is that the one 100x unicorns will pay for the remaining 90% of failed companies.

A bit of luck

A startup win is life-changing for us founders, and for a lucky (or smart) early-stage investor, it can too.

A startup exit also allows everyone to take what they learned and apply it to their new venture, with better chances of achieving that same feat again - and in this world of exits, profits aren’t your problem (yet).