We talk to startup founders all the time, and one of their biggest struggles is wrapping their heads around what will happen with their cap table. Probably the most challenging concept to grasp is that new shares of stock get issued/created instead of transferred between founders and investors.

On a seed round of funding, say, a founder will not 'yield' or sell a percentage of their shares to investors; instead, the company will issue new shares, which causes the percentage distribution to change.

The same math also applies to startup stock options. If you are a startup employee with a stock option pool, you have a fixed number of shares you own, and that number will not change. What might change is the total amount of stock that the company has issued, which effectively changes your percentage ownership.

When you combine that with convertible debt or multiple rounds of additional funding, it can be hard to grasp what will happen with your shares (and, therefore, your money).

So I've been working for the past few weeks on a cap table template that you can use as your company evolves. Please think of this page as the ultimate instruction manual to manage it. I'm not going to make you scroll through the end to download it; you can get it here:

.jpg)

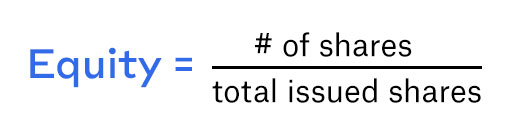

A capitalization table is a simple spreadsheet that shows the equity distribution of a company. The most common company structures worldwide (such as the C-Corporation in the USA) are based on shares of stock that represent company ownership.

For example, if two founders want to establish a company, they might decide to issue one company share. In that case, they own 50% of the business, represented in that one share of stock for each one of them.

As the company gets more complex, with multiple founders or potential rounds of investor funding, the cap table will be critical to tracking the evolution of that share distribution through time.

As the company evolves, the company might also issue special types of equity: such as preferred shares or convertible debt. The cap table should also allow you to keep track of those.

To the question of 'how does a cap table look like': for most startups, the cap table will be a simple table showing each shareholder, how many shares each individual has, and what ownership stake that represents.

It's important to note that the cap table itself is not usually a legally-binding document; it is simply a summary or visual representation of what shareholders have agreed to and signed via legal documents (stock purchase agreements, investments, etc...)

Slidebean's latest round of funding had various investors converting to a particular type of preferred stock, plus the founders, some advisors, and a stock option plan for some of our employees. The legally binding document is dozens of pages long (and it cost us some $30,000 in legal fees), and the cap table was just the summary of what we just agreed.

The summary/visual part of the capitalization table is quite simple; the complexity is in understanding the legal paperwork behind it.

Still, you will often need a summary like this one to show to potential new investors or discuss stock option pools with potential grantees. You can build your own in Google Sheets (ideal to be able to share the link), or you can just grab our free template, which has a neat set of features.

A rule of thumb, such as with anything in life, is that simple = better.

We are not a cap table startup; instead, we like to think of Slidebean as a fundraising OS for startup founders. A good cap table template seemed like a necessary addition.

Here are some of the things our template can do,

Let me break down the sections.

We use a pretty standard nomenclature across our spreadsheets (which extends to our financial model template for startups).

Blue font means inputs: these are values that you want to be editing in order to produce results on the spreadsheet.

Black font means formula results: those cells are outputs and are producing a result based on an input elsewhere on the sheet. Editing black numbers might cause formulas to break, so only do so if our team suggests it.

IMAGE

.jpg)

The top section of the spreadsheet is where most of the inputs go.

Notice how the template is split into different rounds of capital horizontally: from the founding stage to five additional rounds of capital. Also notice how each round is color-coded. That color coding is shared across the entire cap table.

We've added room for up to 6 different roles, including four founders, advisors, and other employees.

.jpg)

Notice how those roles are blue numbers to change their name as needed. Adding more positions is possible, but that might need some help from our team or from our community.

Column C will allow you to enter how many common shares of stock each individual will receive, which will also give you a breakdown of ownership stakes.

Most businesses in the US are established with 1,000,000 or 10,000,000 shares, which allows for a smooth share distribution as new investors come in. Remember, simple is better, so aim for round numbers if possible.

This section is for the Rounds of Financing. Notice how the names of the rounds themselves can be changed as well; you can rename them to Pre-Seed, Seed, Series A- accordingly.

All rounds of funding operate similarly.

The date is the expected date for the round closing. In our financial model templates, this is actually connected to the company's cash flow. The date is also critical for Convertible Note funding since there might be an interest rate for that capital (if you'd like to understand Convertible Notes better, we have a video about it).

New Capital represents the amount invested.

New Stock Option Pool lets you create additional stock option pools for employees with each round of funding. Investors usually expect these pools to be created before their stock purchase so that shares don't come out of their end (and they aren't diluted). This is the way it's been implemented in the cap table.

Round Type lets you pick between Convertible Notes and Priced Rounds.

Priced/Equity Round requires you to define a pre-money valuation that will be used to determine how many shares need to be issued to new investors. Remember the pre-money valuation can be calculated by subtracting the size of the round from the post-money valuation.

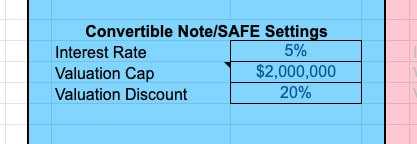

Convertible Note (or bridge funding) allows companies to raise capital without defining a valuation at the time and using the valuation that the future round of investors defines. Note that Round 5 must be a Priced Round; otherwise, the model wouldn't be able to estimate its conversion valuation for the outstanding shares.

You'll need to define an interest rate for the note, a valuation cap, and a valuation discount. For more information on what this means, check out our article on Convertible Notes.

Also, remember that SAFEs are structured similarly to a convertible note, except that they often have no valuation cap and a 0% interest rate.

After each round of funding, the model will automatically calculate the share distribution and display it in a color-coded chart. You'll find the Total Company Shares at the very end of the section.

When an investor requests your cap table, you'll want to share your current cap table, not your estimation of the cap table in the future.

This section provides additional context on each fundraising round, such as the Post-Money Valuation and the Price per Share. Both of these are very important for estimating different Exit Scenarios.

For Convertible Notes and SAFEs, this section estimates the accrued interest before conversion and determines the valuation to be used (either the Cap or the Discount).

This section requires a single input: the acquisition price. The Cap Table template will estimate the return on investment for each of the investors, the founders, and the stock option holders, based on the post-money valuation at which they came in.

For investors, the spreadsheet compares the purchase price at the time of funding vs. the share price at the moment of the exit.

For Stock Option holders, the model first determines if the purchase price per share is higher than the strike price they signed when they received the shares and subtracts the cost of executing the stock options.

How do I keep my cap table updated?

Whenever there's a legal transaction in your company (such as a stock purchase or a stock option grant), you should visit your cap table to add changes.

You can just input the new changes using the blue input cells in the model.

What should I look for in a cap table?

You should be on the lookout for flags such as large shareholders who are no longer with the business, down-rounds (funding that had a lower valuation than a previous round), and the terms behind any preferred shares you find.

Is a cap table confidential?

Cap tables usually operate on a need-to-know basis for private companies. There are rare occasions where you will need to provide someone with full access to the cap table (for example, as part of the data room/due diligence exercise for venture capitalists). Ensure your stock purchase agreements and company bylaws to ensure you are compliant.

Is there a Cap Table template in Excel format?

Yes, you can download a . XLS version of our Google Sheets template.