Newsletter

Weekly news and teardowns on trending startup companies

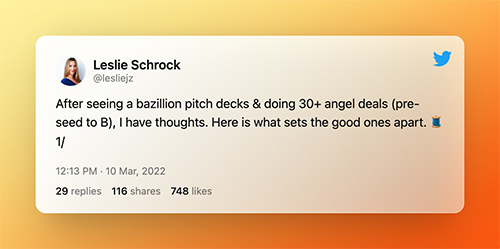

The most relevant Twitter threads of the week

Product of the week brought to you by ProductHunt

Detailed stats on the companies that raised venture capital

Let’s start off with the elephant in the room. Yes, I’m a CEO who will talk to you about ditching the position. A contradiction in itself, but not without its logic. Some of the CEO’s tasks include being the face of the company, planning a strategy that works, and dealing with investors, so the pressure on the CEO is significant and it’s a role that has garnered more attention as of late. Unfortunately, that’s where things go wrong.

Flamboyant and eccentric CEOs have almost become the norm, and some companies have benefited from this overexposure - Musk and Bezos being prime examples. It’s not only about their personalities, but how they also determine company culture, which is vital for the startup’s success. With the proper leadership, the sky’s the limit for most companies, but the same also applies when a CEO is a destructive leader.

These cases best represent the moments in which companies should consider avoiding a CEO. So, how do you go about it? The first step, and the toughest, is changing the mentality that a CEO is vital. What’s critical is leadership, and you can get that by having a team.

Then comes the topic of investors. In most cases, a CEO exists because startups believe that investors need one. Of course, they do - if there’s a CEO then an investor has a throat to strangle, but companies can do without one. Instead, some companies can exploit the cofounders’ potential. Not only that, but it also helps create the need to agree on decisions that will affect the company and distance the startup from an individual’s vision which can lead to trouble.

Unfortunately, the examples are plenty. Take Jeffrey Skilling and Enron. His actions cost shareholders $63 billion. Then there are the (in)famous antics of Adam Neumann and how much they damaged WeWork. Another fascinating case is Uber’s Travis Kalanick. Uber ballooned its valuation under his leadership, yet the environment was so toxic that shareholders demanded he quit, and the conflict didn’t end there. Check out our video on stock options to see how Kalanick affected these.

Now, the idea of ditching the CEO isn’t for everyone. The CEO position is still precious for investors and VCs so a startup without a CEO might repel possible funding. On the other hand, a lot can happen when founders join forces, talents and a clear goal. So, as abstract as the idea sounds, maybe don’t rule it out.

Last week, Ghanaian payment platform Dash was all over the news after raising $32.8 million to help make payments more manageable in Africa, but since then things have changed as Bank of Ghana has ordered the platform to cease operations.

The Bank of Ghana noticed that Dash was operating without approval, and some of the operations even broke the law regarding cross-border payments. Dash should have asked for permission before starting operations. This sparked a debate. How could Dash commit such a rookie mistake? Or did it believe that, given the gray area of regulation that stains fintech, it could operate freely?

This example speaks volumes, not only in Africa but the world. One thing is for sure. What has happened to Dash isn’t new, and it will happen again. Until this growing world of fintech makes up its mind, startups must be on the regulator’s good side. As for Dash, the ideal path would be to get its regulatory affairs in order. We’ll be waiting to see if it does.

https://twitter.com/lesliejz/status/1501969436017774611?s=20&t=kB-OUgCks_IFvRb28lrIcw

If you've worked for a startup or founded one, then you must have heard of employee stock options. I’ve- found that a lot of people, both employees and founders, just don't know how they work. So much so that 55% of startup employees in the US never exercise their stock options which breaks my heart as a founder.

But that's what our 101 series is here for.

As the world gets rid of Russian holdings, investors and venture firms in California are trying to do the same, but it’s not an easy task. Rubles, the Russian curency, was once essential for startups, but in less than a month has lost 40% of its value.

Then, there’s the discussion of where the money comes from. In 2021, Russian investors dished out $9 billion over 232 deals. Keep in mind that some VCs don’t have to disclose who their investors are. So, startups might not know if that money comes from people close to the Russian government, who face possible sanctions.

If a name appears on the sanctioned list, then there’s little else to do but remove them from the list. So, a startup might find itself with fewer funds overnight. It’s a stressful waiting game for investors, VCs, and startups, only bound to get even tenser.